How I plan to raise $500k in 50 days. Day 3

- May, 07, 2016

- Selling Mortgage Notes Learning Center

- Comments Off on How I plan to raise $500k in 50 days. Day 3

Day 3

Good Monday morning to everyone. I hope that you had a great weekend. Today is the 3rd day of my capital raising blog. I took Sunday off so I do have a few updates from Saturday and to finish from last Friday. I also want to address an issue that we all have about our retirements and why I invest in notes.

Last Friday I was finally able to close on a note deal that we had been working on for 5 months. Yes that is a long time but the amount of work that went into it wasn’t that great. We needed to change a few things around with the seller and the borrower to make sure that it was a win win for everyone. I will create a deal case study in the coming weeks for you to review this deal. I will tell you this that we purchased a performing note for 50% of the current UPB and the borrowers credit score is well over 700++. This is the kind of deal that I will never need to do anything with and collect the $300 a month for the next 8 years. Enough about that. Onto the actions from Saturday.

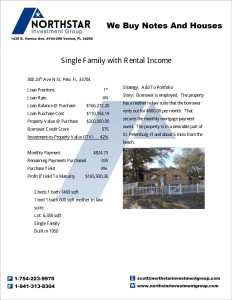

I post an email each week that goes out on Sunday at 7 pm EDT and that is what I was busy preparing on Saturday. This week’s case study can be found on our below.

The great thing about this deal is that the borrower has a little bit lower credit score. That means that they are NOT likely to sell the property and all of the interest will be collected. A rule of thumb is that the higher the borrowers credit score, the shorter that they will own a home. Makes complete sense, they can go at any time, sell and get another loan. This deal is backed up by the two best kinds of collateral that you can get other then a 750++ credit score. The value of the property is very high and there is a mother in law suite that rents out for more that what the borrower pays. Now I don’t know about you but that sounds like a pretty solid deal to me.

The reason that it is so important for me to find deals for the people that I partner with is because I faced the same challenges as you do. Like my retirement going down in 2008 and not being an insider on Wall Street so I don’t feel comfortable playing those games because we live in a world now that the markets are 100% affected by NON fundamental principals. Who has time to keep up on the world news to know if a mud slide happens in Taiwan and flattens 5 Nike production shops that it will make there stock go down, or if the incoming administration doesn’t like how your company is doing things so they send the AG after you. The main reason that I have chosen to invest my money and the people that I partner with’s money into USA real estate notes is because I understand this one thing. Everyone has to live somewhere no matter what is going on outside. Even if the economy tanks, people still need a place to live. You might think that because of all the foreclosures that have happened over the past 8 years that it would be so risky because people will stop paying on their mortgage. That is a myth, know why? Look at how many of those home owners that WANTED to restructure their mortgage so they could stay living there but the powers that be that held their mortgages decided they didn’t want to and would rather foreclose. These people wanted and still want to make their payments they just need a break. That is why it makes so much sense for me because if I can buy a note for a discount, restructure that note and now the borrower is happy and eternally grateful that I took the time to listen to what they needed and now I have a positive cash flow. What could be better?? Here is a little secret, I did’t need to even get on a plane to go visit the borrower. I could if I wanted to but I didn’t have to. Do you see how you can rebuild your portfolio at a very rapid pace by using some simple concepts and holding onto the paper side of real estate? I hope that you can grasp this and take it for your own.

If you would like to discuss this concept of super charging your retirement please call my office at 1-754-223-9970 or email me at scott@northstarinvestmentgroup.com

Respectfully,

Scott Schmitz

Do you have bad credit and would like to buy a home? Click here NOW!

Sign up for NSIG Investors List

Recent Posts

- In 2008 It Was Worth $$$$$ February 21, 2020

- Blank Letter Head September 14, 2016

- Mortgage Note For Sale Sarasota July 19, 2016

- Sell unsecured promissory note July 9, 2016

- Florida 5 Pool of Notes in Tampa, Orlando and Holiday June 7, 2016

- Defaulted Panama City Beach Note May 31, 2016

- Pensacola Defaulted Note May 24, 2016

- How I plan to raise $500k in 50 days. Day 8,9,10 May 18, 2016

- How I plan to raise $500k in 50 days. Day 7 May 13, 2016

- How I plan to raise $500k in 50 days. Day 5 and 6 SPECIAL EDITION*** May 12, 2016